Digital financial technology (known as fintech) has already disrupted the global financial system. Recent improvements to banking, customer experiences, and investment decision-making do not always consider issues such as climate change or energy access, which is why New Energy Nexus is working to foster fintech solutions that can drive 100% clean energy for 100% of the population.

Digital financial technology (known as fintech) has already disrupted the global financial system. Recent improvements to banking, customer experiences, and investment decision-making do not always consider issues such as climate change or energy access, which is why New Energy Nexus is working to foster fintech solutions that can drive 100% clean energy for 100% of the population.

Together with the Yangtze River Delta Hi-Tech Park (Zhaoxiang), we announced 11 startups at our Climate Fintech Accelerator Open Day in Shanghai – the first time our fintech accelerator has been hosted in China!

Our 2023 Climate Fintech Accelerator aimed to accelerate fintech innovation by providing support services to startups such as commercial matchmaking, training, and networking.

The 11 startups accepted into the first batch of our 2023 cohort come from six countries – China, United States, Singapore, the United Kingdom, India, and Nigeria – and are focusing on Web3 and sustainability, carbon accounts, payments, banking, lending, investment, trading, risk analysis, insurance technology, and regulatory technology.

The 2023 Climate Fintech Accelerator is a rolling program and we’re looking forward to receiving applications from all over the world. Apply now and check out more information on our website.

SolarMoney Africa

SolarMoney Africa is dedicated to promoting solar energy adoption in Africa, providing accessible financing for households, communities, and small businesses to purchase solar products for their power needs. SolarMoney Africa collaborates with photovoltaic manufacturers to purchase solar products at lower down payments and sell them to African households through installment payment models. With the use of mobile technology, digital platforms, and innovative financial mechanisms, SolarMoney Africa has become an innovator in the African climate fintech sector.

BlockCarbon

BlockCarbon aims to unlock the global market for Asian carbon assets. The company uses multisource remote sensing technology and deep learning algorithms to develop a carbon asset management platform based on remote sensing and AI technology. This platform identifies potential high-quality carbon asset projects at low cost and verifies, monitors, and manages carbon offset projects. BlockCarbon serves carbon asset developers, traders, and buyers, making carbon assets more traceable, verifiable, and monitorable, encouraging more market participants to generate high-quality carbon assets.

Climatize

Through the Climatize platform, investors can directly invest in renewable energy projects such as community solar, energy efficiency upgrades, and electric vehicle charging infrastructure with a minimum investment amount of US$5. Retail, accredited, and institutional investors can browse Climatize’s project selection and participate in project investments for energy transition. Climatize stands out with its user-friendly product platform and quantifiable environmental impact.

Through the Climatize platform, investors can directly invest in renewable energy projects such as community solar, energy efficiency upgrades, and electric vehicle charging infrastructure with a minimum investment amount of US$5. Retail, accredited, and institutional investors can browse Climatize’s project selection and participate in project investments for energy transition. Climatize stands out with its user-friendly product platform and quantifiable environmental impact.

Carbon Baseline

Carbon Baseline is dedicated to helping clients address challenges in achieving carbon neutrality goals through software products and consulting services. Their team utilizes artificial intelligence and other means to provide clients with climate and sustainable development management and green finance analysis tools with internationally advanced knowledge systems. Their core technology products include carbon emission and reduction calculation software, carbon reduction pathway optimization software, climate risk quantification models, and green finance risk and pricing models.

Climind

Climind

Climind is a Data-as-a-Service (DaaS) platform that focuses on complex climate data such as climate physical risks, transition risks, and nature-based solutions. Climind utilizes technologies such as artificial intelligence and knowledge graphs to extract value from climate data. By establishing data workflows, Climind helps users automate and predict climate risks of projects and businesses, providing customized sustainable strategic and scientifically accurate decision-making.

Nika.eco

Nika.eco aims to help carbon investors discover opportunities and risks before committing time, money, and effort to support a project through interactive reports provided by their software. The company develops a B2B SaaS platform and utilizes remote sensing and artificial intelligence technologies for automated due diligence of early-stage carbon projects. Nika.eco integrates multiple public and proprietary land classification data sources and trains AI models to align with existing methodologies for product iteration.

Tanbii

Tanbii connects the real world (Web2) and virtual world (Web3) by developing a Web5 application and innovative gamified approaches in carbon reduction. By utilizing advanced technologies such as blockchain and artificial intelligence, Tanbii accurately tracks, calculates, and rewards users for reducing their personal carbon emissions. Tanbii turns environmental actions into tangible benefits, presents personal carbon credits in a gamified manner, and supports reforestation projects in real-world environments.

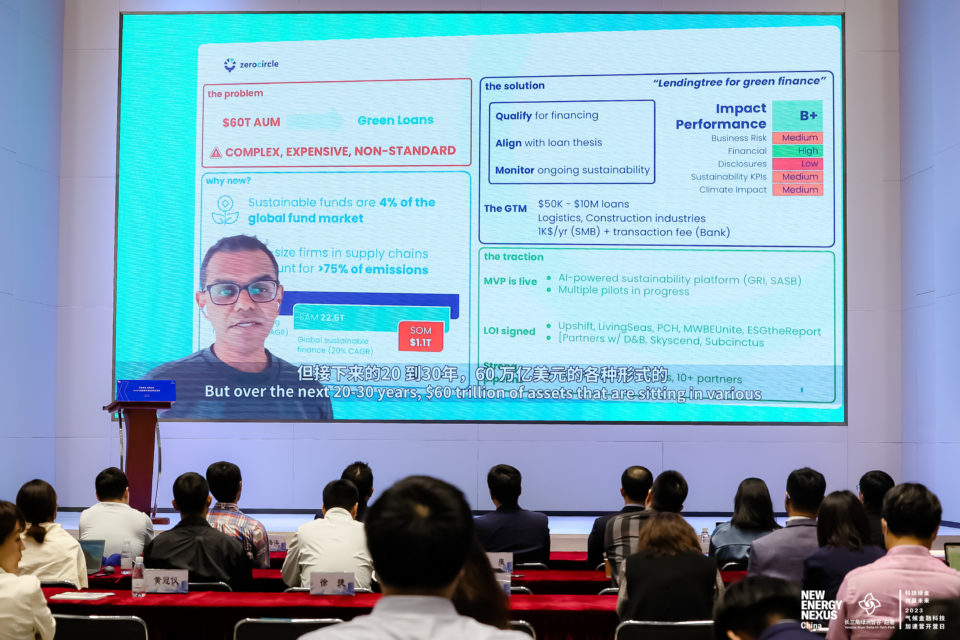

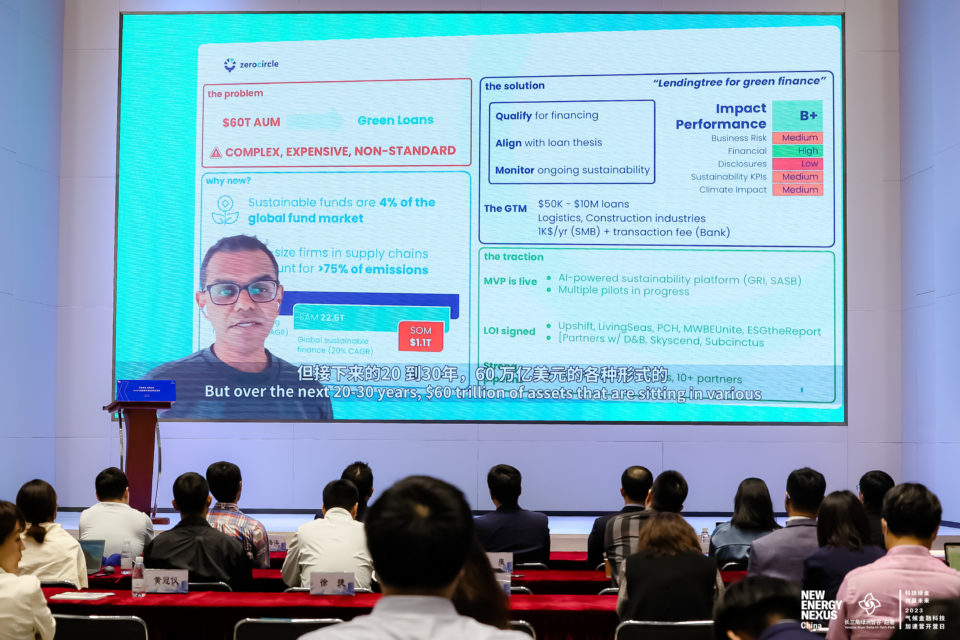

Zero Circle Inc

Zero Circle Inc

Zero Circle provides an innovative green finance market aiming to offer convenient access to green loans for small and medium-sized enterprises while helping lenders track the usage of green loans. The Zero Circle platform automatically conducts eligibility assessments for enterprises based on their policy documents, certifications, provided metrics, and third-party data focused on sustainable development. Compared to manual processes, the platform simplifies the green loan process, saving time and resources.

CarbonNewture

CarbonNewture is a technology company focused on empowering enterprises to address climate change risks and undertake green and low-carbon transformations. They provide solutions, including enterprise carbon inventory, product carbon footprint, zero-carbon strategy consulting, and carbon asset management. They deploy IoT, big data, artificial intelligence, and blockchain to provide comprehensive carbon neutrality digital solutions.

Continuous Regeneration

Continuous Regeneration is committed to building a carbon-neutral DAO (Decentralized Autonomous Organization) network with a focus on digitization and decarbonization. Continuous Regeneration provides end-to-end services in creative planning, artistic presentation, product development, technological application, and project execution for major brands, institutions, and governments in China and overseas.

CarbonSense

CarbonSense assists enterprises in achieving zero-carbon transformations and provides an all-in-one carbon emission management and optimization platform for the manufacturing industry supply chain. They create an enterprise energy and carbon emission data platform using data and Internet of Things technologies, combined with enterprise carbon, green supply chain, and zero-carbon industrial park management systems. CarbonSense aims to provide real-time carbon footprint and carbon asset management systems, reduce operational energy consumption, and change energy-saving practices for enterprises.

Digital financial technology (known as fintech) has already disrupted the global financial system. Recent improvements to banking, customer experiences, and investment decision-making do not always consider issues such as climate change or energy access, which is why New Energy Nexus is working to foster fintech solutions that can drive 100% clean energy for 100% of the population.

Digital financial technology (known as fintech) has already disrupted the global financial system. Recent improvements to banking, customer experiences, and investment decision-making do not always consider issues such as climate change or energy access, which is why New Energy Nexus is working to foster fintech solutions that can drive 100% clean energy for 100% of the population.

Through the

Through the  Climind

Climind Zero Circle Inc

Zero Circle Inc